Debt can be a handy financial tool, be it in the form of credit cards or loans. This tool helps you get things that you’d typically be unable to afford to pay for with cash like a home, your dream car, or an entertainment system. Even though you get to enjoy these things immediately, you’ll eventually have to pay the total amount back in full and with interest on top of it.

While most people are able to meet their monthly debt commitments, many people find themselves saddled with so much debt that they can’t make the monthly payments. After taking on so much debt, they find that their monthly income is eaten away by all their debt repayments. After deducting all those payments from their paycheck, there might be very little left for anything else.

Financial debt isn’t just about numbers on a page. It can also be damaging because of how it’s emotionally stressful, leading to anxiety and even depression. Having too much debt could make you feel scared, stressed, and even angry, all of which can affect your personal relationships as well.

So if you’re buried in debt, how can you start to fix this problem? For starters, you need to have a strategy, that is a detailed plan with a specific goal in mind using a proven method. There are many useful strategies out there that you can follow to manage and eventually pay off your debt, and the most important thing is to find one that works for you. Here, you’re going to learn about a commonly-used debt reduction strategy known as the Debt Snowball Method.

To understand the method, first, imagine a snowball. It starts off small, but as it keeps rolling it continuously increases in size. Soon enough, it becomes so big that it can knock down almost anything in its way. When it comes to the Debt Snowball Method, the ‘snowball’ in question refers to the money you use to pay your monthly debt repayments.

Here’s how it works:

The Debt Snowball Method focuses on paying off the smallest debt balance first. That means that while you pay the minimum amounts on all the others, you’ll be paying as much as you can to eliminate the smallest debt first, as quickly as possible.

As soon as the smallest debt is paid off completely, you can then shift your focus to the next smallest debt you have. Now that you’ve completed one debt repayment, you’ll have more money available to focus on whichever debt you’re eliminating next.

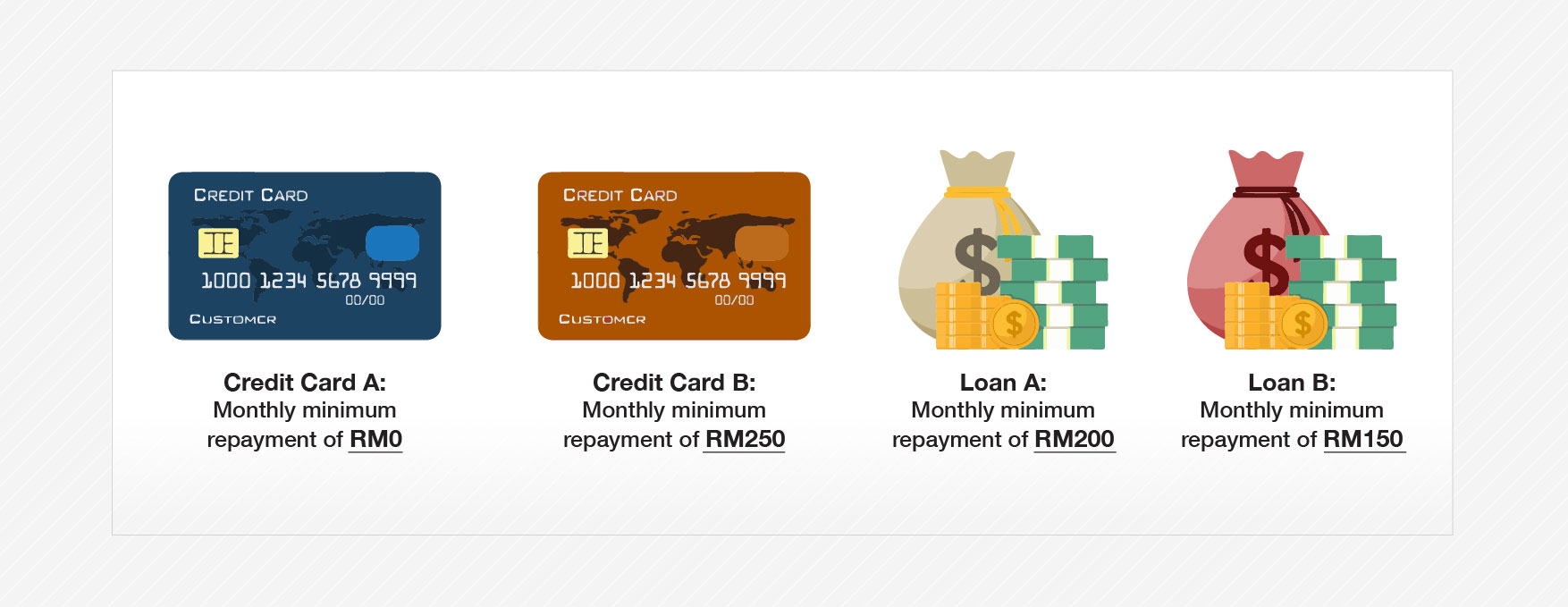

Let’s take a look at a simple example. Let’s say that you have two credit cards and two loans with minimum repayments that you need to make every month. From your monthly income, you have RM 1,000 that you can use to repay your debts.

In this example, you have a total monthly minimum payment of RM 700, and with the budget that you’ve set, you’ll still have RM 300 remaining. What do you do with this extra money in your budget? After making all of the minimum payments, you’ll be putting that additional RM 300 towards your smallest debt, Credit Card A.

You’ll do this every month until Credit Card A is completely paid off. Once that’s done, your debt will then look like this:

What happens now is that the money you were using to pay Credit Card A can now be put towards your next smallest debt, Loan B, thereby repeating the process. As each debt is repaid, you can then roll over your extra money into larger and larger repayments!

There are a few reasons why this method is successful in assisting those struggling with debt.

Firstly, this method has positive effects on your mind and your emotions. As mentioned earlier, debt can be emotionally stressful, especially if you have multiple credit cards and loans to pay off at the same time. Following the Debt Snowball method, you’d be focusing on one debt at a time instead of feeling like you’re fighting all of them at once.

Second, this strategy keeps you motivated. When you eliminate the first debt and make progress, you’ll feel an immediate sense of achievement! It’s essential to feel this way because paying off your debt is a long-term process that takes discipline and dedication. Without progress to keep yourself motivated, paying off your credit cards and loans can feel like an endless battle that’s impossible to win. Targeting your smallest debts first allows you to feel that sense of progress sooner, keeping you driven to keep on going until all that debt is gone!

The third reason why this strategy is popular is that it makes thinking about debt simple, and that’s great for people who prefer focusing on just one thing at a time. Others might prefer going into greater detail, looking closely at the numbers and doing a lot of math. Is one approach better than the other? Not necessarily, as it’s very subjective. You should always figure out what works best for you. The Debt Snowball method might work for some, but not others. The ‘best’ debt strategy is whichever one you can follow consistently. It’s whichever one that helps you stay motivated to keep on going until you reach your ultimate goal: to eliminate all of your debt.

Before following this or any other debt management strategies, you’ll first need to gain a clear understanding of what your financial health is currently like. With your MyCTOS Score report, you’ll get a full snapshot of your debt and get tips on how to improve your credit score. Best of all, checking your CTOS score over time and watching it improve will motivate you even more as you continue working through all your debt!