Bank Negara Malaysia (BNM) has increased the Overnight Policy Rate (OPR) by 25 basis points from 2% to 2.25% on 6 July 2022.

What is OPR?

It is the Overnight Policy Rate (OPR) set by the central bank, Bank Negara Malaysia (BNM). It is a rate a borrower bank has to pay to a lending bank for the funds borrowed.

What happens when OPR increases?

The higher the OPR is set, the more expensive it is to borrow money. Banks’ interest rates will be increased accordingly, so it will become more expensive to get a loan.

To summarise:

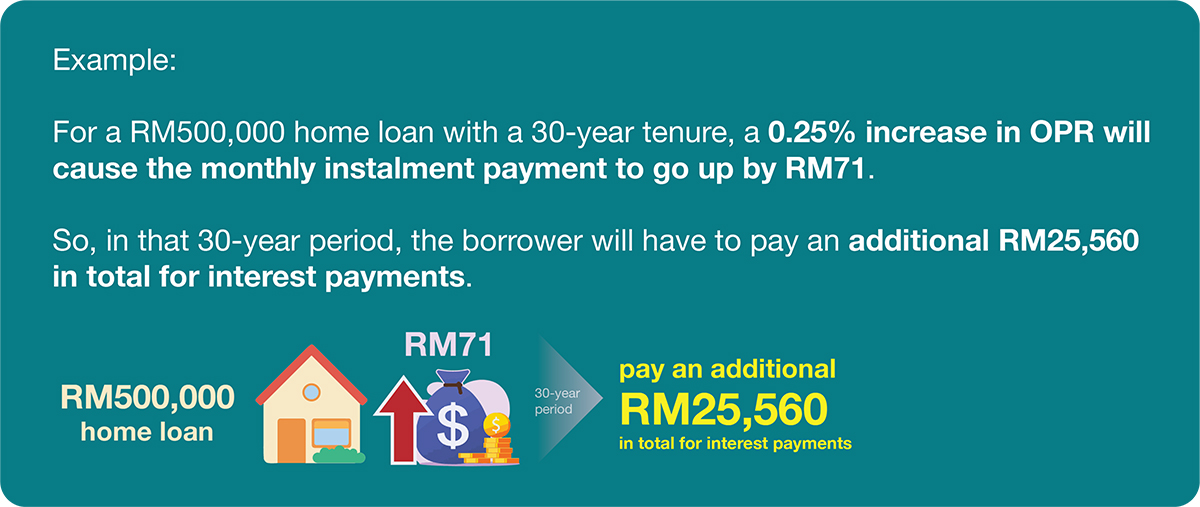

• Monthly loan repayments would increase

If your bank decides to pass on the hike to consumers, it means that your monthly repayments to your bank would increase. This would affect homebuyers, especially if the accumulated amount of interest comes up to a substantial amount over a long period of the loan.

• Loan tenure will increase

This will happen if the monthly instalment amount is maintained. If the old monthly instalment sum is maintained, the repayment period will become longer as the interest rate has increased.

• Harder to obtain loans

The higher the OPR is set, the higher the cost of borrowing would be. This will lead to fewer capital financing opportunities, as banks would tighten the prerequisite requirements for both individuals and businesses to secure loans.

A plus point of increase in OPR

• Fixed deposit rates will increase

Loan interest increasing would also mean that fixed deposit interest, saving interest and so on will increase in tandem too. Therefore, if you have substantial savings, this increase in OPR will enable you to earn more.

Check your latest MyCTOS Score report to stay on top of your credit health and see all your current outstanding loans, so you can better manage your finances to mitigate the OPR increase.