What is CTOS SME Score?

The CTOS SME Score quickly and accurately assesses risk, making it possible for credit grantors to expand their small business loan portfolio and control risk with confidence. It can help make the loan process faster, fairer, more accurate and more consistent, helping more small businesses access the capital they need easily.

► Types of CTOS SME Score

Company SME Score

It’s a single company (ROC) SME Score.

Partnership SME Score

It’s a blended score of a single business (ROB) + each individual business partner.

Sole Proprietor SME Score

It’s a blended score of a single business (ROB) + single business owner.

► Benefits of CTOS SME Score

Reduce risk

Identify potentially high-risk customers quickly so you can make more informed business decisions.

Generate more business

Identify profitable business opportunities by targeting the right customers.

Speedy acquisition process

Pre-screening of potential borrowers improves prospecting, sales and operational efficiency.

Targeted decision-making

Credit limits are recommended based on an SME’s loan exposure and risk appetite of the lender.

Simplified portfolio management

The score supports risk migration, business expansion and portfolio retention strategies.

► Benefits of CTOS SME Score

Reduce risk

Identify potentially high-risk customers quickly so you can make more informed business decisions.

Generate more business

Identify profitable business opportunities by targeting the right customers.

Speedy acquisition process

Pre-screening of potential borrowers improves prospecting, sales and operational efficiency.

Targeted decision-making

Credit limits are recommended based on an SME’s loan exposure and risk appetite of the lender.

Simplified portfolio management

The score supports risk migration, business expansion and portfolio retention strategies.

Frequently Asked Questions

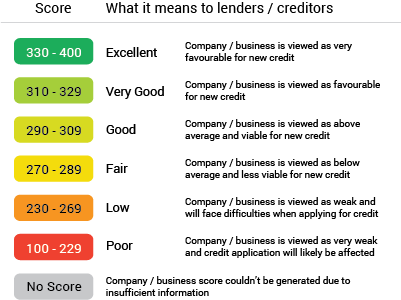

1. What does your CTOS SME Score mean?

Excellent

Company / business is viewed as very favourable for new credit

Very Good

Company / business is viewed as favourable for new credit

Good

Company / business is viewed as above average and viable for new credit

Fair

Company / business is viewed as below average and less viable for new credit

Low

Company / business is viewed as weak and will face difficulties when applying for credit

Poor

Company / business is viewed as very weak and credit application will likely be affected

No Score

Company / business score couldn’t be generated due to insufficient information2. How is CTOS SME Score calculated?

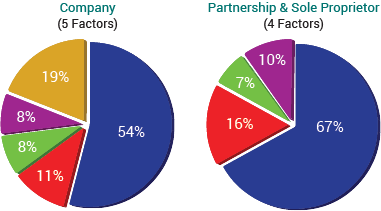

The CTOS SME Score is calculated based on the following factors and weightages.

Payment History

Whether the company / business owner pays loans on time or have missed payments in the pastAmounts Owed

The number of credit facilities and the amount owed to the banksFinancial

The financial performance of your company (balance sheet, profit and loss, cash flow, equity, etc)Credit Mix

Types of loan and credit facilities the company / business owner holdPursuit of New Credit

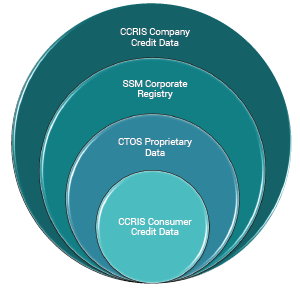

Whether the company / business owner been approved for new credit facilities recently3. What makes up the CTOS SME Score?

Information from the following sources make up the CTOS SME Score:- • CCRIS Company Credit Data from Bank Negara Malaysia.

- • SSM Corporate Registry. Filing data maintained at national registrars, financial data & ratio and business information.

- • CTOS Proprietary Data. Sources maintained by bureau partners.

- • CCRIS Consumer Credit Data from Bank Negara Malaysia. Record of a sole proprietor (where authorised) for scoring of sole proprietor and partnerships.

4. In what ways can the CTOS SME Score be used?

CTOS SME Score can be used to support:

- • Account origination decisions, e.g. establishing initial credit limits or loan amounts, accept/decline/refer decisions, or risk-based pricing

- • Account management activity, driving key decisions such as credit limit changes, setting terms of credit, transaction authorizations, facilities renewal, risk-based pricing, authorization management and early collections activities

- • Marketing activity, cross-selling and discounting strategies

- • A further dimension of risk measurement in combination with other internally or vendor-developed scores

- • The collections process and trade credit decisions

5. Is the CTOS SME Score suitable for any business?

CTOS SME Score is designed for smaller businesses such as small and medium enterprises (SME), sole proprietor and partnership. It also can be used for micro lending. This is because the larger the business, the less impact the owner’s credit score will have on the overall risk prediction of the business itself.

The score is not designed for credit decisioning on foreign companies or large companies listed on the stock exchange.

SME Definition by Bank Negara Malaysia:

- • Manufacturing: Sales turnover ≤ RM50 million or full-time employees ≤ 200 workers

- • Services and other sectors: Sales turnover ≤RM20 million or full-time employees ≤ 75 workers

6. What are the minimum scoring criteria?

The CTOS SME Score has been designed to operate with its own set of minimum scoring criteria that prevents business profiles with insufficient recent credit histories or insufficient business-specific data from being scored.

If the information available on a particular business does not meet the minimum scoring criteria, a “No Score” will be delivered on that credit report.

-

- • The CTOS SME Score will score records that meet any of the following criteria:

- • Gross sales is less than RM50 Million

- • Company has less than 20 directors

- • At least one credit account updated in the last 24 months

- • At least one default / adverse record updated in the last 24 months

- • A sufficient number of business data elements present along with some business credit bureau data

- • Not Dissolved, Struck-off, Wound Up or Liquidated

- • Sufficient financial data is available

- • For Sole Proprietor & Partnership, the following are excluded from scoring:

- • Deceased / fraud

- • Number of business owners > 20

- • No updated consumer or business credit bureau data in the last 24 months

- • The CTOS SME Score will score records that meet any of the following criteria:

-

7. If I am already using a consumer credit score for evaluating small business owners

The CTOS SME Score is different as it incorporates information from the actual business credit report to further refine the risk prediction based on the characteristics of the business itself.

The score will rank order businesses based on the future credit risk associated with the extension of credit to the business. In contrast, a consumer credit score only provides the score for individuals based on their personal credit history and past payment behavior.