Car Loan Eligibility Calculator

How much do you earn?

How much is your monthly commitment?

All loan amounts shown are indicative according to criteria provided by banks and do not constitute a guarantee of bank approval or loan amount obtainable. All loans are still subject to final approval from banks.

You are eligible for an amount of up to

RM 0

With a monthly payment of

RM 0

You can afford a monthly payment of up to

RM 0

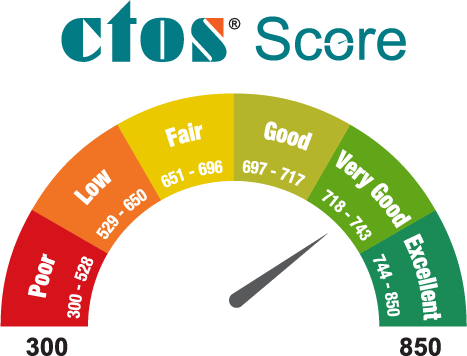

Get MyCTOS Score Report

MyCTOS Score Report contains your full credit history, payment behaviour, your CTOS Score, directorship and business interest, litigation and bankruptcy record (if any) and more.

With MyCTOS Score Report, it helps you to:

litigation or

bankruptcy case under your name

anyone(Trade References)

Frequently Asked Questions

How is my car loan eligibility calculated?

Your eligibility is determined by a few important factors, including income and personal debt servicing ratio.

What is my Debt to Service Ratio (DSR)?

The debt service ratio (DSR) is a debt service measurement that financial lenders use as a rule of thumb when determining the proportion of gross income that is already spent on housing-related and other similar payments.

Am I eligible for a car loan if I already have a loan?

You may still be eligible for a car loan even if you already have another loan. Whether your loan is approved or not may be determined by a number of factors, such as your income level and the information contained in your latest MyCTOS Score report (including CCRIS details and CTOS Score). The final decision on loan approval depends on the bank or lender, but having a good credit score and credit health in general can increase your chances of getting your loan application approved.

What can I do with the results of this Car Loan Eligibility Calculator?

You can search for and choose the best loan for yourself based on the calculator’s results, without wasting time by visiting multiple banks.

How can I apply for a car loan?

You may apply for a car loan by visiting any bank of your choice. Be sure to take along all necessary documents (which may differ from bank to bank) to help speed up the application process.