Data is crucial for making good business decisions. With CTOS Credit Manager, you can get instant access to data and insights for better credit risk management.

Here is a list of all the reports available in CTOS Credit Manager.

CTOS Report

The CTOS Report is the company’s original credit reporting product, and it is still being pulled daily by organizations that need to evaluate potential clients and business partners.

This report is available for evaluating companies, businesses (sole proprietors and partnerships), and individuals.

The report is organized into five sections:

- Section A: Summarized highlights of the entire report

- Section B: Company profile (SSM information inclusive of directorship, shareholding, company charges, financial statements, directorship & business parties, address records etc)

- For individuals, this section will include any directorships or business interests they hold.

- Section C: Credit facilities and bank repayment history (via CCRIS)

- If an individual has an ANGKASA Salary Deduction System (SPGA) loan, it will also be listed here.

- Section D: Litigation information

- Section E: Electronic trade references (eTR) submitted by non-bank third parties, e.g. non-payment of credit terms

To pull this report, you will need to get consent as required under the Credit Reporting Agencies Act 2010.

Click here for a sample CTOS Report for companies.

Click here for a sample CTOS Report for businesses (sole proprietors or partnerships).

Click here for a sample CTOS Report for individuals.

CTOS Score Report

For checking individuals, the CTOS Score Report goes one step further than the CTOS Report. It includes the CTOS Score, a simple and understandable number that indicates credit risk level.

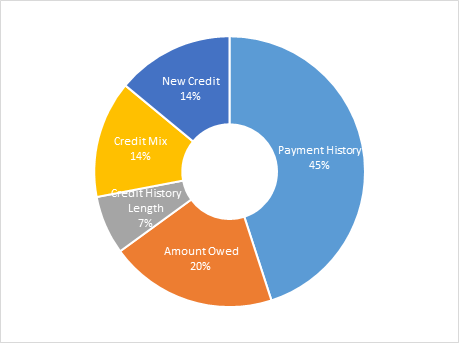

The CTOS Score is a three-digit number ranging from 350–800, calculated using data and insights to determine a subject’s creditworthiness. The higher the score, the lower the credit risk. Five categories are used to measure creditworthiness:

Like the CTOS Report, the CTOS Score Report is divided into five sections:

- Section A: Summarized highlights of the entire report

- Section B: Any directorships or business interests held by the individual.

- Section C: Credit facilities and bank repayment history (via CCRIS)

- If the individual has an ANGKASA Salary Deduction System (SPGA) loan, it will also be listed here.

- Section D: Litigation information

- Section E: Electronic trade references (eTR) submitted by non-bank third parties, e.g. non-payment of credit terms

To pull this report, you will need to get consent as required under the Credit Reporting Agencies Act 2010.

Click here for a sample CTOS Score Report.

CTOS SME Score Report

The CTOS SME Score Report helps you make faster, consistent, more profitable credit decisions and assess SME credit risk instantly.

Powered by FICO, the score determines the creditworthiness of an SME. The business is assigned a score using information from the actual business credit report, further refining the risk prediction based on the characteristics of the business itself.

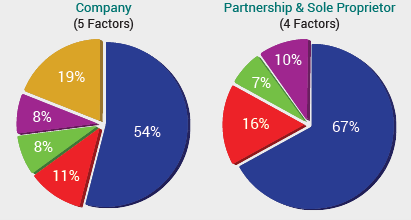

The CTOS SME Score is designed for scoring smaller businesses, including sole proprietors and partnerships. The scoring is derived from the company’s information if it is already incorporated as a private limited company. For sole proprietors and partnerships, a blended score is used, combining the both the business credit risk and the personal credit risk of the owner(s).

The score ranges from 100 to 400, with a higher score meaning lower credit risk. It is calculated based on the following factors:

Payment History

Whether the company / business owner pays loans on time or have missed payments in the past

Amounts Owed

The number of credit facilities and the amount owed to the banks

Financial

The financial performance of your company (balance sheet, profit and loss, cash flow, equity, etc)

Credit Mix

Types of loan and credit facilities the company / business owner hold

Pursuit of New Credit

Whether the company / business owner been approved for new credit facilities recently

The CTOS SME Score Report contains the following sections:

- Section A: Summarized highlights of the entire report

- Section B: Company profile (SSM information inclusive of directorship, shareholding, company charges, financial statements, directorship & business parties, address records etc)

- Section C: Credit facilities and bank repayment history (via CCRIS)

- Section D: Litigation information

- Section E: Electronic trade references (eTR) submitted by non-bank third parties, e.g. non-payment of credit terms

To pull this report, you will need to get consent as required under the Credit Reporting Agencies Act 2010.

Click here for a sample CTOS SME Score Report for companies.

Click here for a sample CTOS SME Score Report for businesses (sole proprietors or partnerships).

CTOS Lite Report

This is a lighter version of the CTOS Report for you to do basic evaluation of a company, business, or individual. You do not need consent to pull this report.

This report contains two sections:

- Section A: Summarized highlights of the entire report

- Section B: Company profile (SSM information inclusive of directorship, shareholding, company charges, financial statements, directorship & business parties, address records etc)

- For individuals, this section will include any directorships or business interests they hold.

Click here for a sample CTOS Lite Report for companies.

Click here for a sample CTOS Lite Report for businesses (sole proprietors or partnerships).

Click here for a sample CTOS Lite Report for individuals.

SSM Report

You can check the exact business profiles and company reports published by the Companies Commission of Malaysia (SSM), directly from Credit Manager. This can be used to help you evaluate a company’s background and its financial stability.

There are a few things to take note of:

- When companies are incorporated with SSM, they need to disclose the particulars of their directors and shareholders, as well as appoint a company secretary. Companies also need to comply with annual financial disclosure requirements.

- Sole proprietors and partnerships only need to register basic particulars with SSM. They can operate under a trade name, which is registered with SSM. In return, these businesses only need to pay a yearly renewal fee. There are no financial disclosure requirements.

- A limited liability partnership (LLP) is an alternative business vehicle which combines the characteristics of a company and conventional partnership.

Click here for a sample SSM report.

Click here for a sample business profile.

Click here for a sample LLP report.

Idaman Report

The Idaman report shows the company documents submitted to SSM in the form of scanned images. It is useful if you need to view the company’s original incorporation forms, memorandum and articles of association, director and shareholder particulars, etc.

Click here for a sample Idaman report.

MDI (Bankruptcy) Report

The Malaysian Department of Insolvency (MDI) administers bankruptcy cases. It also acts as a liquidator for companies that are wound up. In line with this duty, MDI also provides search services on an individual’s bankruptcy status or the winding-up status of a company. For your convenience, you can obtain this report from Credit Manager.

Click here for a sample MDI (Bankruptcy) report.

International Business Report

CTOS provides international business reports in partnership with CTOS Basis, giving you instant access to insights on companies and organizations from over 200 countries. Data is collected from various sources; where available information will be collected from official registries similar to SSM. Our network of trusted local partners allows us to collect information locally, ensuring the information delivered is accurate and up-to-date.

The international business report includes company information such as:

- Company details

- Credit rating and credit limit recommendation

- Financial information and analysis

- Share capital structure

- Directors/principals

- Public record information

- Payment experience

- Financial data

Reports requested can be instantly downloaded from Credit Manager. However, if a company’s information is not available, you have the opportunity to conduct a fresh investigation. It will take approximately six to 14 working days depending on the country.

Click here for a sample international business report.

Singapore Business Reports

If you require in-depth information about companies registered in Singapore, CTOS partners with CTOS Basis to provide detailed company profiles of over 500,000 Singaporean companies. The following types of reports are available in Credit Manager:

- Business Profile (BPF) – providing basic credentials and operating status of the entity. It contains the company’s registered information, description, credentials and key players.

- Strategic Corporate Information (SCI) – providing instant access to a company’s financial performance. It contains the company’s financial records over the past 5 years with accounting ratios

- Financial Statements (FSH) – the original copy of the financial statement filed as submitted by the company to the Accounting and Corporate Regulatory Authority (ACRA) of Singapore for compliance regulation.

These reports are available in one working day.

Click here for a sample BPF report.

Click here for a sample SCI report.

Click here for a sample FSH report.

E-Court Search

You can search for detailed information about a court case or legal claim with E-Court Search in Credit Manager. The search is done using the court case number.

The E-Court Search report includes information about:

- Statement of Claim – a document that provides context to the dispute, allegations made against the defendant, and the remedy sought by the plaintiff.

- Writ of Summons – this will inform the defendant of the legal suit and command the defendant to enter appearance for the suit within the period stated.

- Court Order (if available) – the outcome of the case as decided by the judge.

E-court search is only applicable to cases from 2010 onwards. It also does not cover cases in Perlis, Sabah, and Sarawak.

The report is available in one working day.

Click here for a sample E-Court Search report.

Land Title Search

For your convenience, land title searches are available in Credit Manager. Before entering into any transaction involving land, it’s prudent to do a title search beforehand. From this, you can determine the true owner of the land, as well as any caveats or encumbrances on the property which may complicate the transaction.

CTOS’ land title search service covers all states and federal territories in Malaysia. Do note that the title searches in Credit Manager are private land title searches (carian persendirian), not official land title searches (carian rasmi). The only difference is that official searches come with the Land Registrar’s certification (stamp and signature) – otherwise the information contained within is identical.

To conduct a land title search, you will need the following information:

- Title type

- Title number

- Lot number

- State

- District

- Bandar/Pekan/Mukim

A property’s postal address cannot be used to conduct a land search – the full title detail is still required. You can get this information from the original title, quit rent bill (bil cukai tanah) or proclamation of sale.

The land title search results take between 1 to 7 working days to be available, depending on the state. It may also be possible to fail the search if the Land Office has no records of the title, or incorrect information has been given.

Click here for a sample land title search report.

KYC Screening Report

CTOS KYC Screening service allows you to check the real identity or background of your customer, supplier or partner, protecting your business against risks like money laundering or terrorist financing.

CTOS KYC Screening offers a cost-effective, pay-per-search and structured risk data screening to help organizations align with global compliance and enforcement standards, which cover sanction lists, enforcement, politically exposed persons (PEPs) and adverse media watch lists.

This is in partnership with LexisNexis Risk Solutions, part of RELX Group, a leading global provider of information and data analytics used by 100% of the top 50 US banks, 80% of Fortune 500 companies and serving customers in more than 100 countries.

The KYC Screening Report contains 3 sections:

- Search Criteria – this section displays your input for the KYC search.

- Number of Matches – this section shows the number of matches in each category, namely:

- Sanction List – the entity appears on one or more sanction lists

- Enforcement

- PEP

- Adverse Media

- Match Details – this section displays the details of each match. It is sorted in order from most relevant to least relevant. Note that some matches may be irrelevant, as persons with the same name are also captured in the search. If possible, ensure that other details match such as the ID number, date of birth, address etc.

Click here for a sample KYC Screening Report.

Monitoring Report

When you set up monitoring on a subject, the system will send you a Monitoring Report if there are any changes of the subjects monitored in these areas:

- Directorship

- Shareholders/ownership

- Financial status

- Legal cases or litigation

- Electronic Trade Reference (eTR)

Click here for a sample Monitoring Report.

Ultimate Beneficiary Ownership Report

The ultimate beneficial owner (UBO) of a company refers to the natural person who has ultimate effective control over the company. CTOS UBO Report can help you uncover this information.

Click here for a sample UBO Report.