Ever received an unexpected charge?

In today’s world, safeguarding your finances is more critical than ever.

Identity theft and credit fraud can strike when we least expect it, devastating your bank accounts, credit score, and overall well-being.

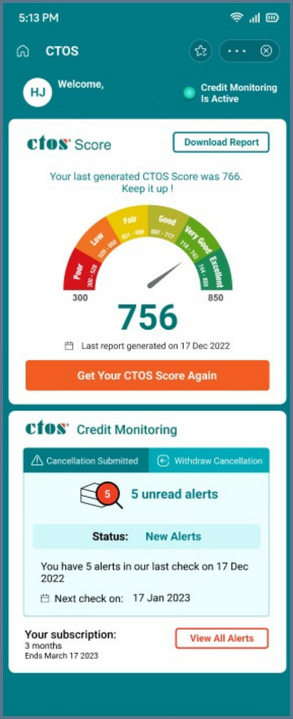

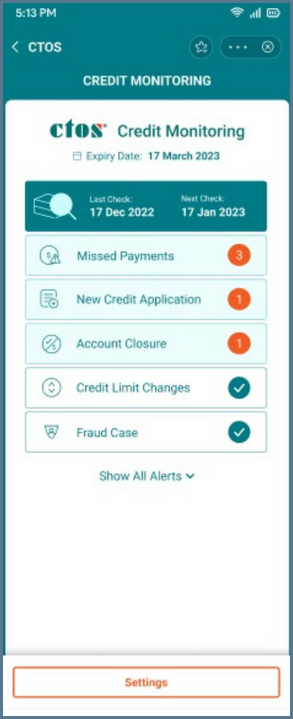

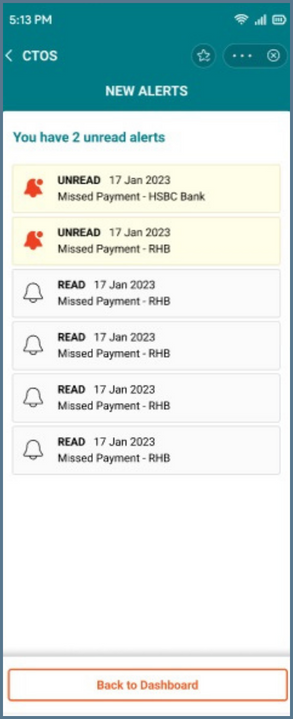

CTOS Credit monitoring services track activity on your credit report and provide alerts for changes like new accounts, missed payments, and potential fraud.

This helps you gain insights into your financial health and identify issues early, enabling you to address them before it’s too late.

Why credit monitoring matters?

Approx. 1.3 Million

Had their stolen identity used to open financial accounts

8 in 10

Received suspected scam outreach via text, email, phone call, and other methods

1 in 2

Say friends/family were scam victims

Over RM5.2 Billion

Lost to 71,833 reported scams from 2020-2022

Benefits of CTOS Credit Monitoring

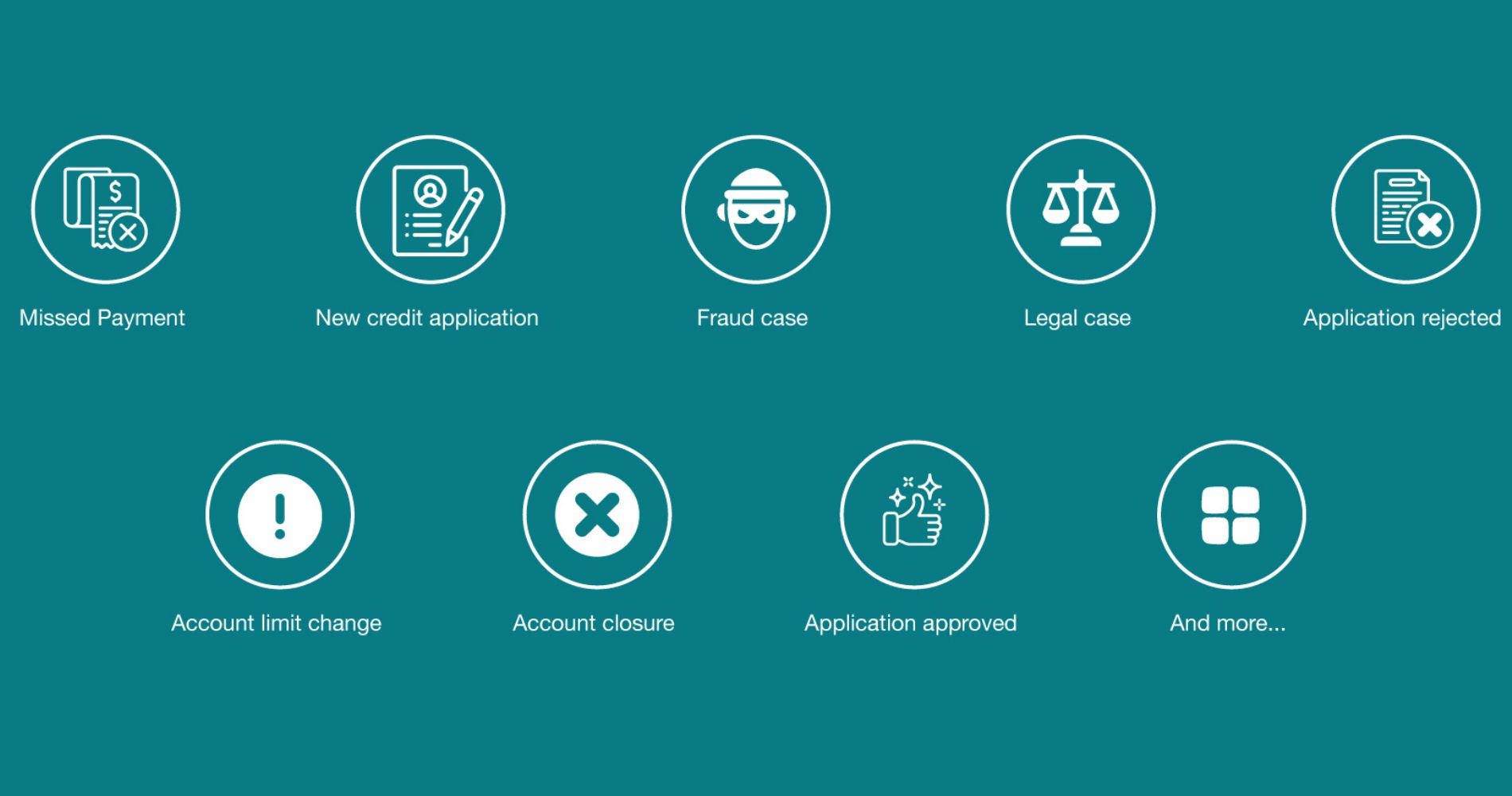

Powered by CCRIS and our breakthrough credit monitoring technology, you’ll get to stay on track with your financial health and monitor your credit profile. Receive monthly alerts for:

Stolen Identity, Shattered Finances: How Credit Monitoring Could Have Saved Jessie From Devastation

Jessie was a single mother of two, working two jobs to support her family. She worked tirelessly to ensure her children, Jacob and Janet, had everything they needed.

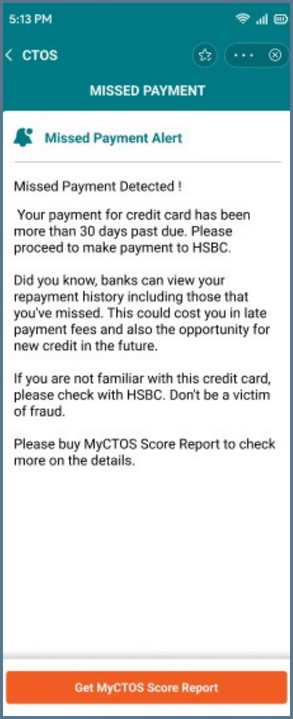

One day, as Jessie was walking home from work, she received a call from the bank. They informed her that she had missed payments on a personal loan of RM 100,000 over the past 3 months. The bank warned that if the payments were not made promptly, foreclosure proceedings could commence, potentially leaving Jessie and her two children without a home.

Jessie was stunned. She adamantly told the bank that she had never taken out such a loan and had no knowledge of the account.

Immediately, Jessie rushed to the police station to report the incident. After a painstaking two-month investigation, it was revealed that Jessie’s personal identity had been stolen and sold on the dark web. Fraudsters had then used her stolen information to open a loan account, making her the victim.

This nightmare could have been avoided if Jessie had had credit monitoring services to alert her of any suspicious activity on her bank and credit accounts.

Fortunately, we can help you avoid a similar fate. Start your credit monitoring journey now and stay ahead of fraudsters.

Don’t let your financial future be compromised – take control today.

It’s time to make a choice!

Will you start credit monitoring and safeguard your financial future? Click here to begin enjoying the priceless peace of mind you deserve.