Common Reasons for a Low CTOS Score

- Late or Missed Payments: Consistently missing due dates on bill payments is a major factor in a low score. Late payments, accounts sent to collections, bankruptcies, foreclosures, legal suits, or judgments can severely impact your score.

- High Credit Utilization: Using a large portion of your available credit indicates potential financial stress. Maxing out your credit limits, such as on credit cards, will lower your score. Ideally, using less credit is better; however, using a little bit of credit and paying it back on time shows lenders that you’re good with money. It’s better to have this kind of activity on your record than to have no credit history at all.

- Short Credit History: A brief credit history provides limited insight into your financial behavior. The longer your history with various credit types, like mortgages, car loans, or credit cards, especially with a good repayment record, the better for your score.

- Thin Credit File:A thin credit file signifies minimal or nonexistent credit history, typically due to infrequent credit use. Lenders find it challenging to assess your creditworthiness without sufficient information. This situation can occur if you rarely use credit or have moved to Malaysia, where your previous credit history is not recognized. Additionally, relying solely on cash or debit card transactions won’t improve your credit score, as these activities do not demonstrate credit usage. To start building your credit history, consider obtaining a straightforward credit card from a reputable bank. Ensuring timely bill payments will help establish your ability to manage credit effectively.

- Limited Credit Mix: A narrow range of credit types can limit the growth of your score. Having diverse types of credit, such as credit cards, mortgages, or car loans, can enhance your score.

- Frequent Credit Applications: Applying for multiple new credits in a short period can seem risky to lenders, suggesting potential financial strain or the intent to accrue significant debt. Lenders prefer to lend to individuals who appear not to need the credit urgently, as those in desperate need may pose a higher repayment risk.

- Stolen Identity: Unrecognized loans or purchases under your name could indicate identity theft. If your personal information has been compromised and used to open fraudulent accounts, this can severely affect your credit score. Monitor your credit report and bank statements for any unfamiliar activity. For more information on how to deal with stolen identity and its impact on your credit score, click here.

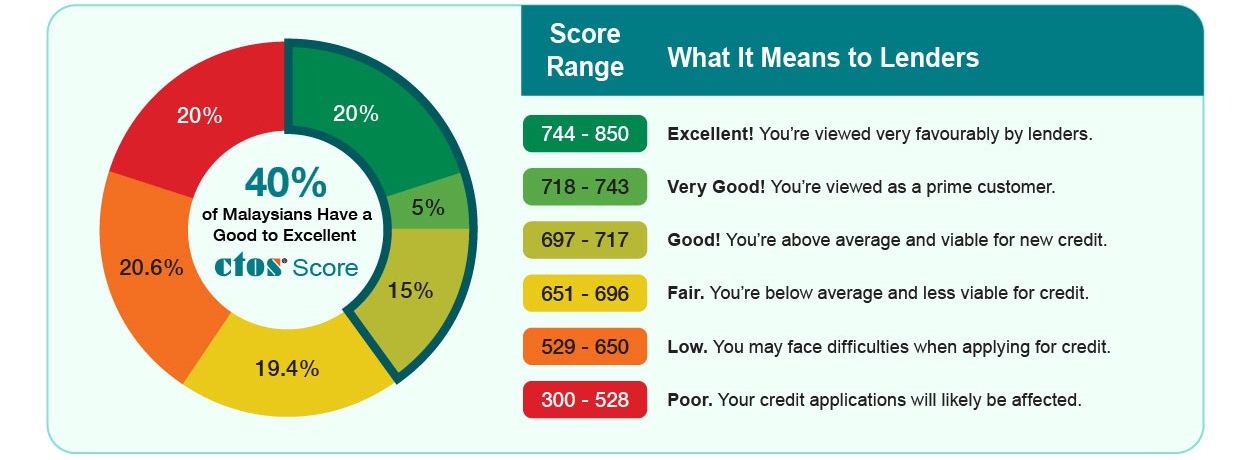

Understanding Your CTOS Score

Your CTOS score reflects your creditworthiness, based on various factors including payment history, amounts owed, credit history length, credit mix, and new credit. Each factor has a different weight on your score:

- Payment History (45%): This is the core of your score, indicating your reliability in repaying debts.

- Amounts Owed (20%): This represents your credit utilization. High balances relative to your credit limits can lower your score.

- Length of Credit History (7%): A longer history provides more data for lenders, typically benefiting your score.

- Credit Mix (14%): A variety of credit types shows you can manage multiple forms of debt.

- New Credit (14%): Opening several new accounts in a short period may signal financial strain, affecting your score negatively.

Strategies to Improve Your CTOS Score

Improving your CTOS score requires a multifaceted approach, focusing on responsible financial management and consistent monitoring.

- Timely Payments: Automate bill payments or set reminders to ensure you pay on time.

- Debt Management: Reduce your credit utilization by paying down debts, especially on high-interest accounts.

- Credit History Maintenance: Keep older accounts open to lengthen your credit history.

- Diversify Your Credit: Responsibly manage different types of credit to enhance your credit mix.

- Mindful Credit Applications: Apply for new credit only when necessary to avoid unnecessary hard inquiries.

- Regularly checking on your credit report: Regularly review your credit report to correct inaccuracies. Note that CCRIS updates are available on the 10th of each month from Bank Negara Malaysia (BNM). You may also dispute any inaccuracies and track your progress in addressing the negative factors.