Article was originally published by TheStar.com.my

FOR most of us in the formal economy, a credit score is an “adult report card” that is tagged on us by some of the key institutions or companies that require a form of background check before they enter into deals or contracts with us.

FOR most of us in the formal economy, a credit score is an “adult report card” that is tagged on us by some of the key institutions or companies that require a form of background check before they enter into deals or contracts with us.

Basically, it can be said that a credit score reveals whether a person is a good payer who fulfils his or her financial obligations when in a binding contract.

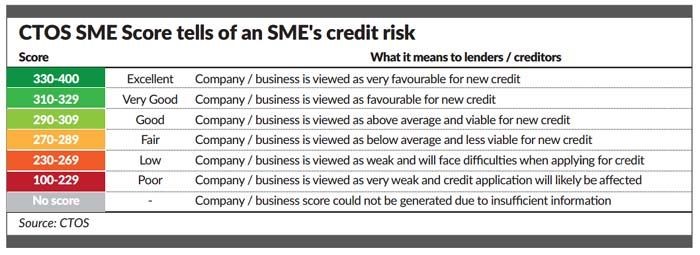

CTOS group chief executive officer Dennis Martin told StarBiz that a credit score is a three-digit number and is derived from analysing a person’s credit information, and this represents the creditworthiness of an individual or a small and medium enterprise.

“The credit information comes from a number of sources including the Central Credit Reference Information System and CTOS’ own proprietary databases, ” Martin said.

There are several credit reporting agencies that are regulated under the Credit Reporting Agencies Act 2010 and CTOS is among one of them.

Dennis said among the institutions that would have interest to look at credit scores included banks, other credit givers and lenders, potential employers, telecommunication companies, letting agents and landlords, debt collection agencies and insurance companies.

He said these companies needed a person’s expressed consent before they could access a person’s credit information, and privacy is not an issue here since these are also governed by the Credit Reporting Act 2010.

Martin explained that a person’s credit score was calculated based on past behaviors in relation to previous facilities he or she might have had.

“This has been proven to be predictive of future behaviors. In other words, if you have previously paid your bills and on time then you are likely to pay your bills and on time in the future, ” he said.

He added that the actual mechanics of building this score were proprietary but in general it covered five main key areas.

“These are assessed with each having a different weightage or level of importance to build the overall score, ” Martin said.

“For CTOS’ score, the five areas are: payment history (45%), amount owed (30%), credit history length (15%), credit mix (10%) and new credit (10%), ” he explained.

Payment history pertains to whether a person pays their loans on time or have they missed payments in the past.

This is the main factor of consideration that determines your credit information and scores.

The second factor would be the amount that is still owed or outstanding obligations such as loans for an individual.

“This is your credit utilisation. And it shows how much credit you are using compared to your available limit, ” Dennis says.

“Thirdly, a person’s credit history length which constitutes to 15% of the weighting of his or her overall score relates to how long an individual has held a credit facility, ” he added.

The fourth and last factor has an equal weighting of 10% respectively, according to Martin.

Credit mix details the type of loans outstanding he or she has such as a housing, car or a credit card loan while new credit pertains to whether a person has had new credit facilities approved recently.

In summary, a credit score can determine a business’ or an individual’s financial success because sometimes getting the extra credit line can provide the much needed lifeline to purchase a big ticket item or for working capital expenditure.

For an individual this could mean the credit facility to purchase a new house or even pay for his or her immediate medical expenses.

While for a business, a healthy credit rating can determine if a company would be able to have access to extra financing for it to spend on extra machinery or capital expenditures to expand their businesses.

This could mean an edge that it can have to stand out above and over its competitors in the market.