How To Read CTOS Report (Company)

Our classic CTOS Report was designed to help you better evaluate your potential clients and vendors. We display an array of information from company financials, litigation, trade references and even banking payment history so that you can make more informed decision.

This report is structured to five (5) distinct sections:

Section A – Report Snapshot

Section B – Company Profile (SSM information)

Section C – Banking Payment History (CCRIS Information)

Section D – Litigation Information

Section E – Trade Referee Listing

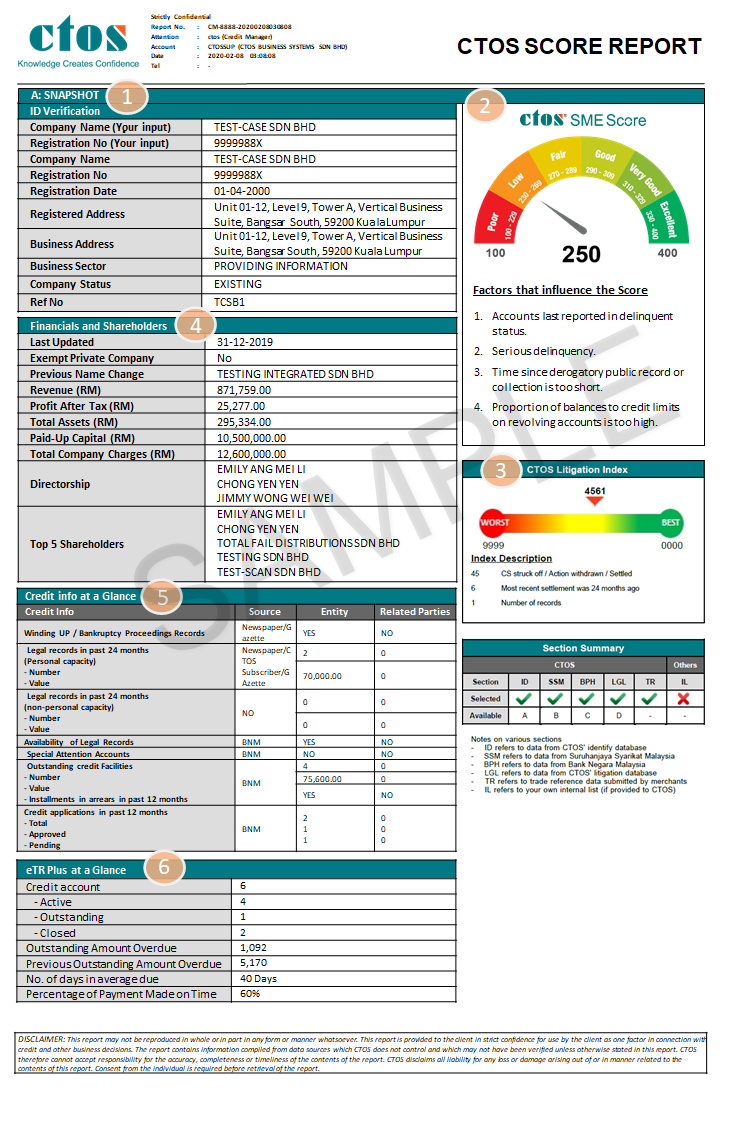

Section A – Report Snapshot

Snapshot (Highlights of entire report)

- ID Verification

This section displays the company’s basic details i.e. Name, Registration Number, Registered Address, Business Address, Business Sector & Company Type. - CTOS SME Score

The CTOS SME Score quickly and accurately assesses risk, making it possible for credit grantors to expand their small business loan portfolio and control risk with confidence. - CTOS Litigation Index

An index that summarises the severity of information in Section D of this report. - Financials & Shareholders

This section displays the financial highlights, directorship(s) & Top 5 shareholders based on the latest CCM information.

(Not applicable for sole-proprietor/partnership reports) - Credit Info At A Glance

This section displays the highlights on the following information for the company + its related parties;- Litigation

- Banking Payment History

- Credit Application

- eTR Plus At A Glance

This section displays the highlights on the eTR Plus information for the company. eTR Plus is non-bank monthly payment information shared by third-party sources and aggregated by the Credit Reporting Agency.

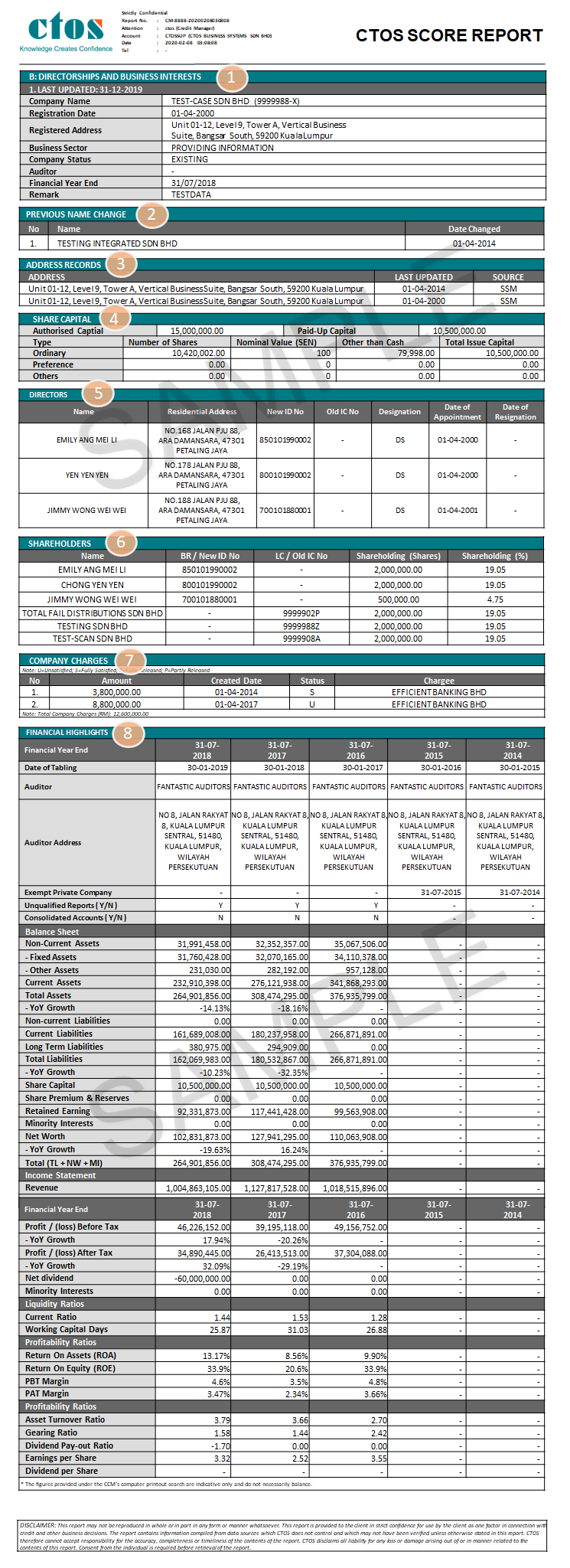

Section B – Company Profile (SSM information)

Company Profile (SSM information – inclusive of Directorship, Shareholding, Company Charges, Financial Statements, Directorship & Business Parties, Address Records, Financial Health Indicator etc)

- Directorships And Business Interests

This section displays the company’s basic details i.e. Name, Registration Number, Registered Address, Business Address, Business Sector & Auditor & Auditor & Financial Year End. - Previous Name Change

This section displays the name the company was previously known as, where applicable.

(Not applicable for sole-proprietor/partnership reports) - Address Records

This section displays all known addresses registered to this company and the source of information. - Share Capital

This information is obtained from the Companies Commission of Malaysia (CCM). The section displays the company share capital information.

(Not applicable for sole-proprietor/partnership reports) - Directors

This information is obtained from the Companies Commission of Malaysia (CCM). The section displays the complete listing of the company directors & secretary.

(Not applicable for sole-proprietor/partnership reports) - Shareholders

This information is obtained from the Companies Commission of Malaysia (CCM). The section displays the complete listing of the company’s shareholders.

(Not applicable for sole-proprietor/partnership reports) - Company Charges

This information is obtained from Companies Commission of Malaysia (CCM) and displays the complete listing of the company’s charge.A charge is an interest or right which a lender or creditor has obtained in an asset of the company by way of security that the company will pay back the debt.

(Not applicable for sole-proprietor/partnership reports) - Financial Highlights

This information is obtained from Companies Commission of Malaysia (CCM) and displays the complete listing of the company’s financial details. The financial details cover the latest 5 years record of the company.

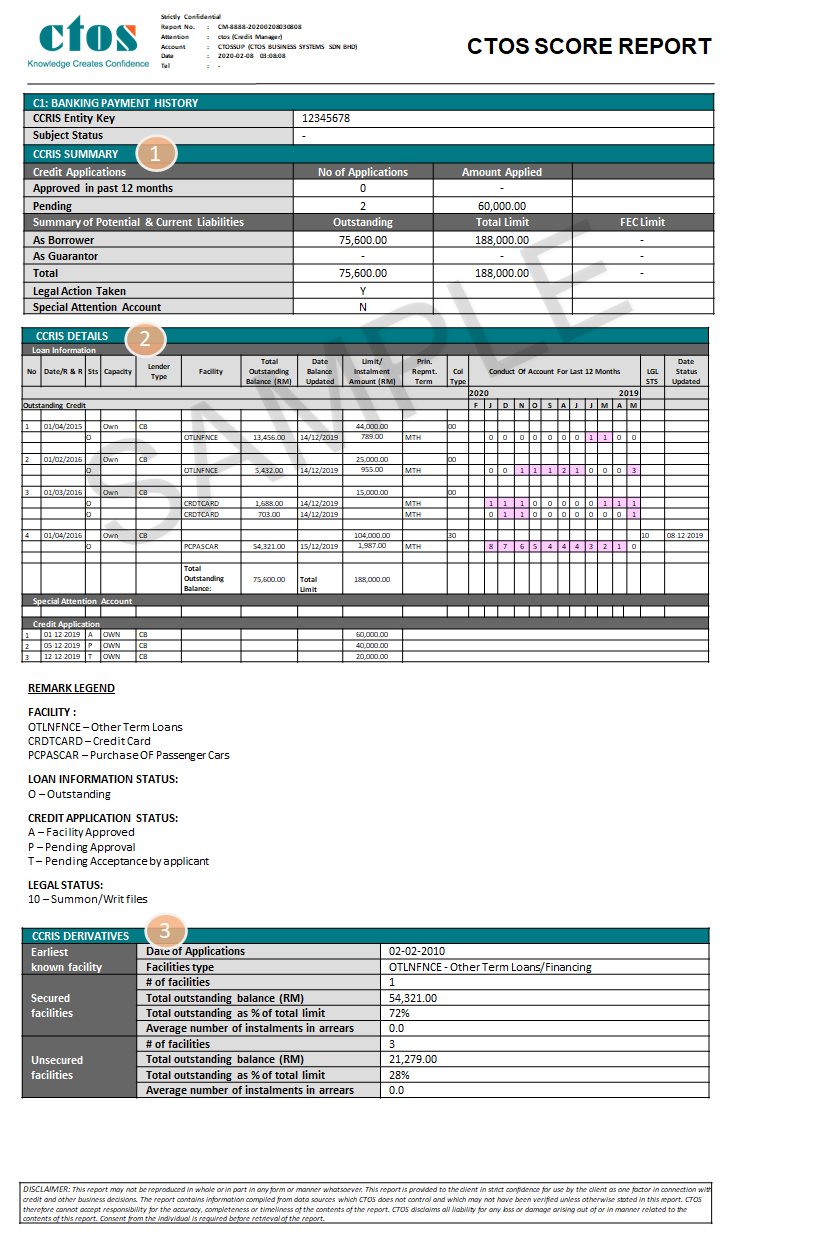

Section C – Banking Payment History (CCRIS Information)

Banking Payment History (CCRIS Summary + CCRIS Details + Dishonoured Cheques)

- Banking Payment History (CCRIS Summary)

This section displays the following: –- Number of approved facilities.

- Number of pending facilities.

- Total amount outstanding.

- Total limit.

- Foreign Exchange Contract amount.

- Banking Payment History (CCRIS Details)

Based on the summary reflected above this section displays the breakdown of each facility. With the following details: –- Status of facility.

- Capacity.

- Lender Type.

- Facility Type.

- Total Outstanding Balance.

- Limit.

- Repayment term.

- Collateral Type.

- Conduct of account.

- Legal Status.

Special Attention Account.

Credit Application Details.

- Banking Payment History (CCRIS Derivatives)

This section is divided into 3; earliest known facility, secured facilities & unsecured facilities as a quick guide.

Section D – Litigation Information

Litigation Information

- Legal Cases (subject as defendant)

This section displays a summary of all cases tagged to the company as the defendant. - Case Details

This section displays the details of each case shown in the summary above. - Anti-Money Laundering Act (AMLA)

A set of procedures, laws or regulations designed to stop the practice of generating income through illegal actions.In the event there is a match to the money laundering database a display of name & registration number will appear.

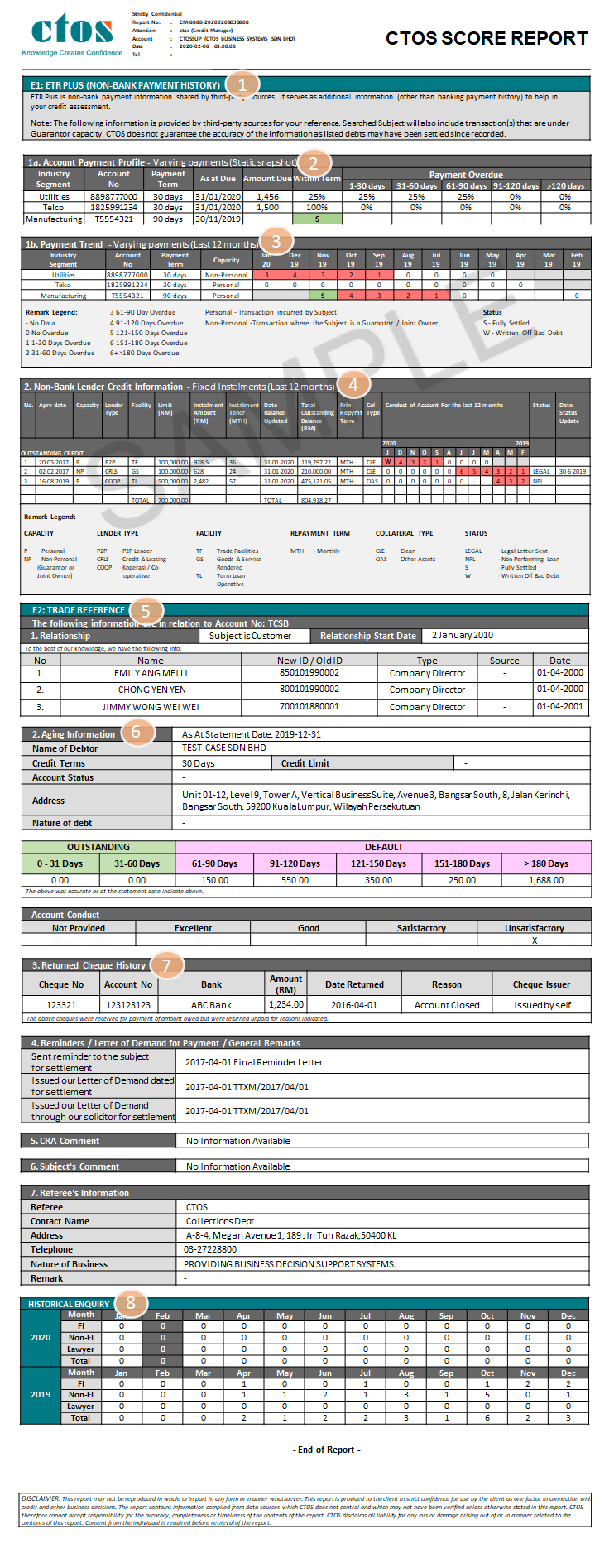

Section E – Trade Referee Listing

Trade Referee Listing

- eTR Plus

This section displays the eTR Plus’s references tagged to the subject’s company.

eTR Plus is non-bank monthly payment information shared by third-party sources and aggregated by the Credit Reporting Agency. Data is obtained directly from member companies (contributors) and is made available on CTOS credit reports. It serves as additional information for credit assessments. - This section shows a snapshot of the aging information for accounts with varying monthly payment amounts of the company.

- This section shows the payment trend for accounts with varying monthly payment amounts of the company.

- This section shows the payment trend for accounts with fixed monthly payment amounts of the company. This is similar to BNM’s CCRIS layout, but exclusive to Non-Bank lenders information

- Trade Reference

This section displays the references tagged to the subject’s company.

A trade reference is the payment experience information provided by a supplier on its customers. - Aging

An account receivable aging is a report that lists unpaid customer invoices and unused credit memos by date ranges. - Returned Cheque

A cheque that cannot be processed because the writer has insufficient funds. - Historical Enquiry

This section displays the total number of subscribers who have made an inquiry on the subject in the past 24 months.