Article was originally published by TheStar.com.my

THE upcoming listing of CTOS Digital Bhd has put the spotlight on credit reporting, a technology-driven multi-billion industry that holds vast potential in the Asean region.

Credit reporting agencies such as CTOS collect and analyse information on both consumers and corporations producing reports which are then used by a myriad of organisations who find it useful or even essential in dealing with their clients and customers.

In corporate Malaysia, little is known about this industry, although last year StarBizWeek revealed that quiet moves have been taking place in the sector.

Aside from private equity firm Creador acquiring CTOS back in 2014, another big deal was the sale by RAM Holdings Bhd of its 33.15% stake in RAM Credit Information Sdn Bhd (RAMCI) in 2019.

CTOS then already had a 16% stake in RAMCI, which it bought in July 2019 for RM27mil from Main Market-listed Omesti Bhd and hence was a front runner for RAM’s stake in RAMCI. However, following a sales process, a surprising bidder emerged as winner, namely Ireland-based Experian, a global information services company that’s been boosting its presence in the region. The deal was said to value RAMCI at close to a record breaking RM300mil, which was a steep price-earnings multiple of around 65 times, indicating the growth potential of credit rating agencies.

and hence was a front runner for RAM’s stake in RAMCI. However, following a sales process, a surprising bidder emerged as winner, namely Ireland-based Experian, a global information services company that’s been boosting its presence in the region. The deal was said to value RAMCI at close to a record breaking RM300mil, which was a steep price-earnings multiple of around 65 times, indicating the growth potential of credit rating agencies.

Today, CTOS owns a 26% stake in RAMCI, since renamed Experian. CTOS is the market leader in Malaysia, followed by Experian.

The Malaysian credit scoring industry has been experiencing a compounded annual growth rate (CAGR) of 12.9% from 2016 to 2020. Last year, industry revenue hit RM225mil and is expected to almost double to RM406mil by 2025, predicts IDC Malaysia.

But it is the entire Asean region where the growth potential lies.

“Despite having a large population, the Asean credit reporting industry revenue remains a fraction of that of developed nations, indicating robust growth opportunities, ” explains Dennis Martin, CTOS group chief executive.

According to IDC’s market research report contained in CTOS’ draft prospectus, Asean’s total credit reporting revenue for 2020 stood at a mere RM991mil for a population of 669 million people. In contrast, the US, which has a population of 331 million, enjoyed an industry revenue of a whopping RM28bil that year.

It is the US market which is the birthplace for modern credit reporting.

According to IDC, the US is the largest market for credit reporting and operates largely on what they call the FICO score. Consumer credit has been a significant driver for the US credit reporting industry growth.

The second-largest market for credit reporting is the UK, which stood at RM3.9bil last year, points out IDC.

Meanwhile, IDC reckons that growth for the Asean region from 2021 to 2025 should be 10.8% annually, much higher than in developed markets such as the US and the UK.

“Growth potential in Asean comes from greater penetration and usage of credit reporting services and further expansion of other services such as analytics, eKYC, application automation and direct-to-consumer services, building from its current base which has fewer products and services available to customers when compared to developed countries, ” IDC explains.

Driving financial inclusion

One reason why central banks around the world are supportive of the growth of credit reporting agencies is that they tend to boost financial inclusion among the unbanked and underbanked populations. This is more so in places like Asean.

However, the growth of such agencies is still nascent. But that also indicates the significant growth opportunities for players like CTOS.

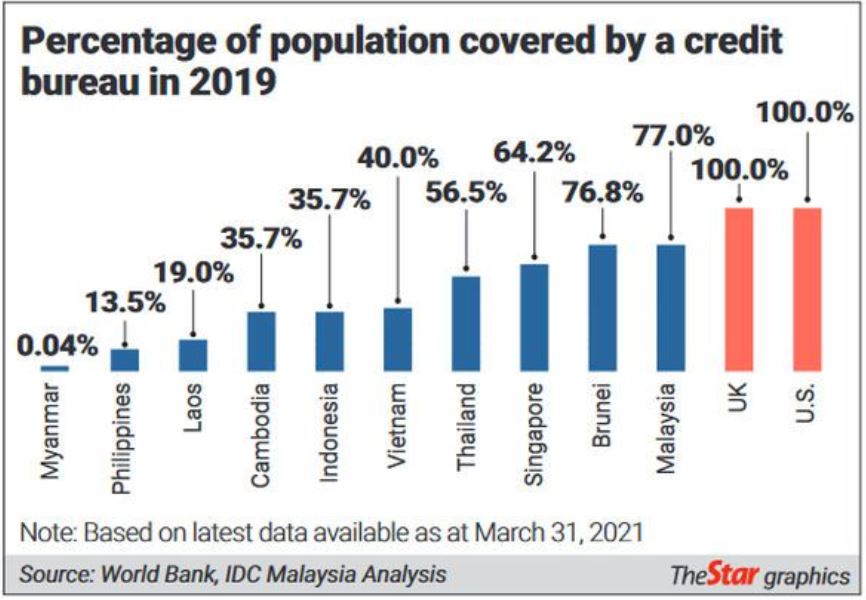

IDC points out that while markets such as Malaysia and Brunei have significant coverage of the population, key large markets such as the Philippines and Indonesia still have large segments which do not have any credit record coverage. Myanmar just established its first credit bureau in 2020.

“Coverage by a credit bureau is highly tied to access to financial services such as banking. Markets with high numbers of unbanked residents will also have low numbers of credit bureau records, ” the research outfit points out.

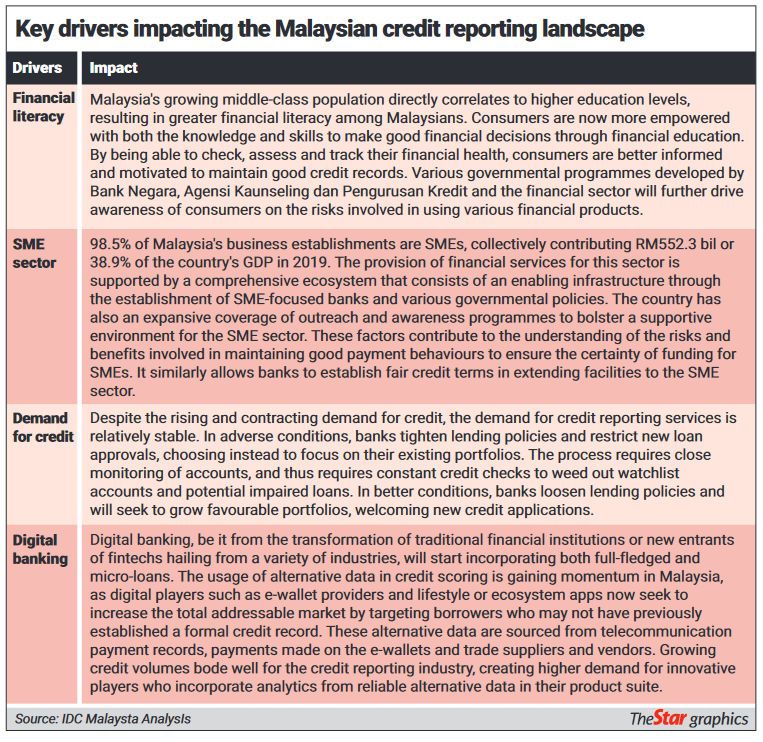

Another interesting aspect of the growth of credit reporting is the usage of new technologies.

IDC notes that governments, the banking sector and many fintech players through joint efforts with partners from other industries such as telecommunications have looked towards alternative credit assessment techniques using behavioural and social data as new models of customer credit assessments. “Such schemes have found good traction in markets such as Indonesia and the Philippines, with both having sizeable and underserved populations.

“Using digital technologies to bolster credit reporting coverage and capabilities will be a key enabler of financial inclusion and loan growth in Asean, ” IDC says.

As for the Malaysian market, IDC says it is still in its early stage of growth, with a total addressable market that is projected to grow at a CAGR of 28.2% from now until 2025.

Various industries are expected to use more credit reporting services and local agencies are likely to create more industry specific solutions to address the demand.

IDC lists the industries concerned as automotive, media technology, insurance, healthcare, real estate and retail.

But IDC adds that “the largest vertical by value is and will remain with the financial services sector at RM682.3mil in 2025”.