2. Avoid taking on new debt within a short time frame

Every time you apply for credit, the record will appear in your CCRIS and your credit score usually takes a hit. Multiple applications in a short span could suggest to the banks and lenders that you are a riskier borrower and desperate for credit. So try not to apply for any other credit for at least six months before you apply for new credit.

If you have multiple debts and want to use one loan to cover the others, there is a safer and more effective way—look for a licensed lending platform that offers debt consolidation services. This service allows you to combine all your debts into a single, manageable monthly repayment, often with a lower interest rate.

3. Improve your debt-to-income ratio

3. Improve your debt-to-income ratio

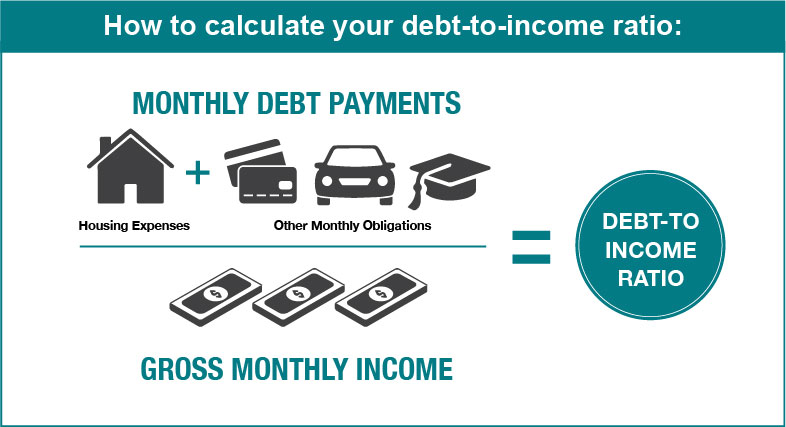

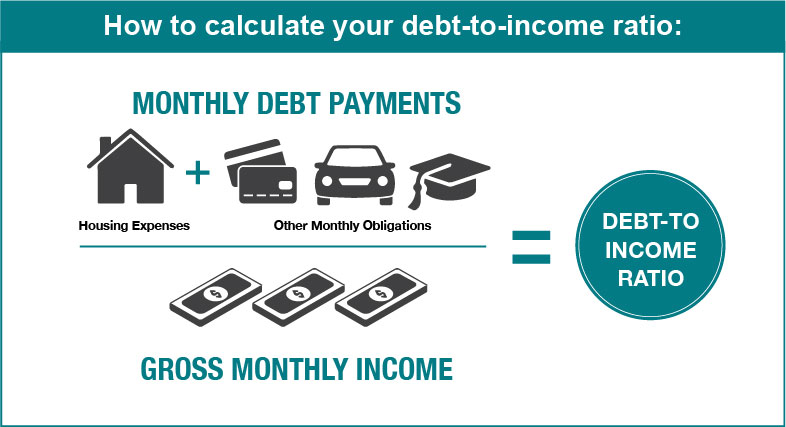

Debt-to-income ratio indicates the percentage of your gross monthly income that goes towards your monthly debt payments. Try to keep all your monthly loan commitments to not more than 40% of your net monthly income.

Lower your ratio by reducing your debts and increasing your income. For instance, you could make extra payments to pay off your debt faster, and take on an extra job or start a small side business to increase your income.

4. Compare terms and rates of different loan providers

Different lenders will offer different rates because they all have their own different risk appetite. Do enough research to identify lenders with the best loan rates and terms, and check if there are any hidden fees.

However, comparing loans from different banks and lenders can be overwhelming, especially if you’re not familiar with the process. That’s where a safe and trusted lending platform like Direct Lending can help. They simplify the process by allowing you to compare multiple loan options in one place—saving you time, effort and improving your chances of getting approved.

Direct Lending’s team of loan consultants will take the time to understand your financial situation and recommend the most suitable loan option based on your needs and requirements. Plus, their services are completely free, with no hidden fees or upfront costs.

5. Obtain & organise income documentation

Whether you are self-employed or work for someone else, you will need to have the right documents handy as proof of your income. Generally, you’ll need your latest 3 months’ salary slips / EPF statements (if employed by a company), or the latest 3 month’s bank statements (if self-employed). Each lender has a preferred way of doing business, and is likely to request a different set of documents. The faster you can provide the required documentation, the quicker they can process your loan application.

For example, with Direct Lending, government employees only need to provide 1 month’s salary slip, while private sector employees need to submit the latest 3 months’ salary slips and 3 months’ bank statements to check for loan eligibility.

Ready to Apply? Let Direct Lending Be Your Trusted Loan Partner

Applying for a loan can be a bit overwhelming, whether it’s your first time or not, but you don’t have to do it alone. Whether you are looking to consolidate your debts to have lower monthly commitments, cover unexpected expenses or simply get the best loans for your needs, Direct Lending is always ready to help.

As a trusted licensed lending platform, Direct Lending offers:

✅ Access to more than 30 banks, koperasi and licensed money lenders

✅ Transparent loan comparisons with no hidden fees or upfront payments

✅ A safe and secure platform to avoid scams and illegal lenders

✅ Help from A-Z—making your loan journey smoother and stress-free

Need help with your loan application?

Check your loan eligibility with Direct Lending today and get the best loan options that match your needs—completely free of charge.

Check My Eligibility Now