How to create a budget that works for you

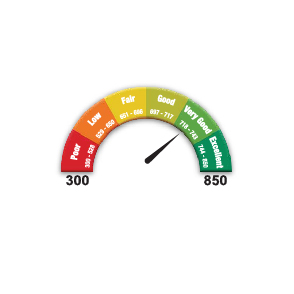

Know where you stand with MyCTOS Score report

You need to find out where your money is going each month. Know your full financial picture with MyCTOS Score report to help you plan your finances better when it comes to creating a budget. You’ll be able to see all your monthly commitments for your car loan, housing loan, personal loan, credit cards and more. You can also monitor your outstanding balance for better budget planning. If you have missed payments in the past, try to get current and stay current.

Cut back where possible

Once you’ve analysed your monthly spending and seen the categories, it’s time to cut back where you can. You don’t necessarily have to stop every activity that’s enjoyable, such as eliminating your daily coffee from your favourite café. The key is to find a balance between being able to still enjoy your money by getting the things you like, but not overindulging or spending in excess.

If your analysis shows that you do a lot of impulse buying, this is a good place to start cutting back. Housing loans are typically the biggest expense for most, so explore options of refinancing your home, downsizing or moving to a more affordable neighbourhood.

Make sure goals are clear & specific

It’s useful to set goals for yourself, such as saving for an emergency fund, retirement, vacation or even paying down high interest debt. However, instead of just noting you want to ‘save more in an emergency fund’, switch to ‘I want to save RM1,000 by the end of the year’.

Keep track of your progress

It’s important to track your progress to ensure you don’t get derailed from your carefully-planned budget. Budgeting apps can help you track your progress, or you can do it the old-fashioned way with pen and paper. After each month, check to see if you did everything you set out to do, and if there were any other expenses that were not outlined in your budget plan.

It can take a few months to get used to a new money mindset and strategy, so don’t beat yourself up if you make a mistake or something unexpected happens – it’s all part of the learning process.

Know your full financial picture with your latest credit report